Underlying trend is a very important concept when analyzing and trading a financial market using cyclic principles. When teaching the use of Sentient Trader a running joke amongst the study group is that the answer to any question is "underlying trend", and this is not actually far from the truth!

Underlying trend is a term applied to any cycle, and it means exactly what it says:

The (underlying) contribution to the direction of price (referred to as trend) of cycles longer than the cycle being considered.

Of course the cycle that is being considered is expected to cause the price to rise and then fall, but this contribution towards the price movement takes place against a backdrop of the contribution of many other cycles. In particular, of cycles that are LONGER than the cycle being considered (shorter cycles contribute against the backdrop of the cycle being considered in addition to all longer cycles). This "backdrop" of the contribution of longer cycles is called underlying trend.

Underlying trend can be described in vague terms such as:

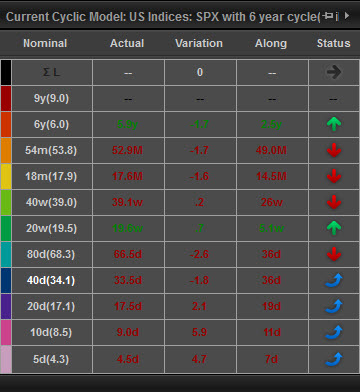

Underlying trend can also be referred to more specifically as a number, which refers simply to the net number of cycles which are influencing price in a particular direction. This is very simply calculated by looking at the Current Cyclic Model table, and adding up the number of upward pointing arrows for cycles longer than the cycle being considered, and then subtracting the number of downward pointing arrows for cycles longer than the cycle being considered. Here is an example:

And so, by summing the arrows in the Status column for all cycles longer than the cycle being considered, we work out that the underlying trend of each cycle is:

OK, so those are the underlying trends for each cycle. How do we use this information? Hurst recommended that one should only trade under circumstances of supportive underlying trend, in other words only trade long when the underlying trend is positive, and only trade short when the underlying trend is negative.

In that case the only cycle we would be interested in trading long given the above cyclic model is the 5-day cycle (the 54-month cycle has only one cycle longer than it, and so the underlying trend calculation is not reliable). All the other cycles are candidates for short trades. Cycles with neutral underlying trends could be traded in either direction, or not at all, a matter of personal preference.

If you are using Hurst's original trading methodology to trade then Sentient Trader will follow the above-mentioned guideline, and will allow trades in either direction on a neutral underlying trend. If you are using the Sentient Trading methodology then you would use the Sentient Trading Matrix to determine whether trades should be made under various underlying trend conditions.

In the above discussion we have calculated underlying trend by summing the contribution of all cycles longer than the cycle under consideration. Hurst proposed that when it comes to trading a cycle in fact only the two cycles longer than the trading cycle need to be considered. This is called the short underlying trend. Sentient Trader uses the short underlying trend to make trading decisions, as proposed by Hurst. But it is advisable to apply your own filter to your trading, and if the overall or full underlying trend is strongly negative, exercise caution when taking long trades, even if the short underlying trend is positive.

The short underlying trends (counting only two cycles longer than the cycle being considered) for the above example are:

Note that when referring to short underlying trend it is adequate to describe it as simply negative, neutral or positive.

Considering short underlying trend only one would take long trades on the 5-day and 10-day cycles, short trades on the 20-week and 40-week cycles, and possibly consider trades in either direction on the other cycles.